FOR MDs WHO WANT TO PROTECT THEIR INVESTMENT OF TIME, MONEY & ENERGY INTO THEIR CAREERS

Experience Ultimate Income Protection

For The Career You’ve Worked Hard For. Guaranteed.

Fill Up The Application

Protect the career you’ve invested time and money into with InsuranceMD’s True Own Specialty Insurance so you can experience the freedom of protecting your income, future and family—no matter what happens.

100% Tax-Free Benefit

Earn Additional Income

Flexible, Customized Plans

Save 30%-50% Off Your Plan

100% Tax-Free Benefit

Earn Additional Income

Flexible, Customized Plans

Save 30%-50% Off Your Plan

You’ve Invested Tons Into Your Career. Why Leave It To Chance?

Every day, a “routine” moment turns into a crisis. From violent outbreaks to increased crime and invasions, being vigilant is no longer optional. The fact remains that emergencies happen when you least expect—and you’re the one in charge of your family’s safety and well-being.

You’re a rare breed. Becoming an MD requires you to invest time, energy and money that most people aren’t willing to sacrifice. It’s why your future can be incredibly rewarding with the hopes that the return on your investment will outweigh the sacrifices of Med School, Residency and the early years of building your career.

But there’s a problem. This return on investment assumes you’re capable of working. If you have an accident or develop a condition that prevents you from working, you’re still on the hook for all your financial responsibilities.

From student loans to a mortgage and the day-to-day expenses of supporting your family, MDs carry more risk than the typical employee. Unfortunately, many don’t realize this until it’s too late and an unexpected crisis has occurred.

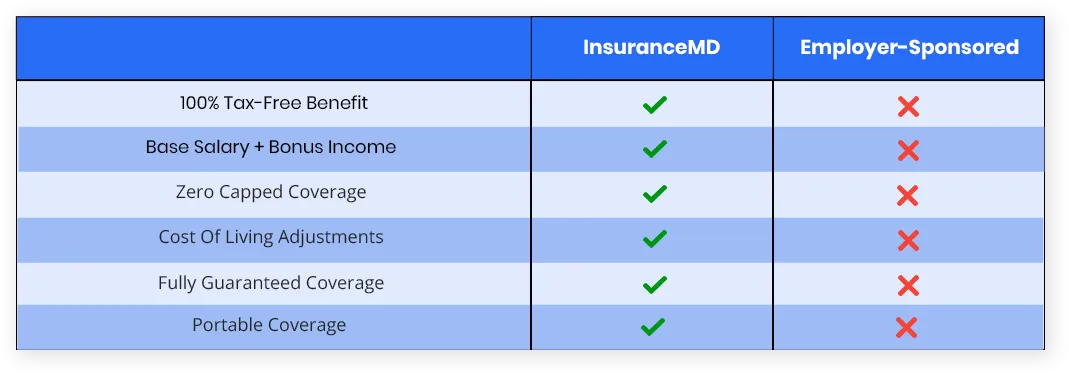

Which leads us to the number one myth MDs believe: that your employer-sponsored coverage is enough.

Myth: your employer-sponsored coverage is enough

Unfortunately, this couldn’t be further from the truth. Sure, your coverage might be enough…if you’re the office receptionist. In nearly every case, once you dig into the details–the coverage you’re receiving is inadequate and creates massive liability if something happens to you.

Instead, you deserve the coverage reserved for a specialized MD that offers undeniable protection.

Myth: your employer-sponsored coverage is enough

Unfortunately, this couldn’t be further from the truth. Sure, your coverage might be enough…if you’re the office receptionist. In nearly every case, once you dig into the details–the coverage you’re receiving is inadequate and creates massive liability if something happens to you.

Instead, you deserve the coverage reserved for a specialized MD that offers undeniable protection.

True Own Specialty using InsuranceMD is the gold standard.

When it comes to disability, “true own specialty occupation” is the gold standard. This insurance provides the most comprehensive definition of disability and protection for MDs like you. Under this definition, you’ll be covered if you are unable to fulfill specific aspects of your occupation, whether or not you’re able to perform other work.

For example, if you’re a lung specialist but can’t perform the procedures you used to, you can still work in a medical field (or any field of your choice.) Even though you’re able to work, the fact that you can no longer work in your original field means you receive the full benefit, tax-free.

But there’s another problem. Finding the perfect policy can be a chore—which is where InsuranceMD comes in. Instead of wasting time sorting through confusing options, our team is here to walk you through the process on a zero-obligation, free call.

Worst case scenario? You leave with peace of mind and clarity on what to do next.

Minimize Risk Maximise Protection

Minimize Risk

Maximize

Protection

100% Tax-Free Benefit

Ensure you get 100% of your benefit tax-free with True Own Specialty insurance.

Earn Additional Income

Experience the flexibility of earning additional income on top of your full benefits payout.

Ultimate Peace Of Mind

Nothing matches the peace of mind that comes with full income replacement and flexibility.

Protect Your Investment

Protect the career you’ve invested hundreds of thousands of dollars into in the case of an unexpected event.

Unmatched Flexibility

Work in another medical or medically-related field, or do something completely different. Your choice.

Complete Customization

Experience the flexibility of earning additional income on top of your full benefits payout.

Non-Cancellable & Guaranteed Renewable

Ensure your rates never change while getting the peace of mind that your policy will renew every year.

At InsuranceMD, we’re here to make the process easy, simple and Effortless.

So, How Does InsuranceMD Work?

Book a Call

Pick your coverage, and our team will handle the paperwork and logistics to ensure you’re 100% covered.

Receive Quotes

Our team will use your unique experience, age, history and life factors and present competitive quotes.

Ultimate Protection

Pick your coverage, and our team will handle the paperwork and logistics to ensure you’re 100% covered.

Don’t Wait Until An Unexpected Emergency To Discover Your Coverage Is A Huge Liability

Discover the power of InsuranceMD’s True Own Specialty Occupation insurance compared to others.

Have Questions? Let’s Answer Them

Our mission is to help MDs like you achieve clarity when it comes to protecting their futures.

Who is this for?

InsuranceMD is specifically created for MDs of all types who are looking to protect the massive investment of time, energy and money that comes with their careers.

What makes InsuranceMD different?

Our expert team brings XX years of working directly with MDs to ensure they get the best possible coverage at the most competitive rates. We work hard on your behalf to ensure you get exactly what you need to protect your income and family.

Who does the underwriting?

Your True Own Specialty Disability insurance will be underwritten by one of the following: Ameritas, Guardian, MassMutual, Mutual of Omaha, Principal, or The Standard.

At what age should I consider True Own Specialty?

To maximize your protection at the best rates, the best time is when you are earlier in your career and in good health to ensure lower premiums and protection during the early stages when you’re still building your income and career trajectory.

What about my employer-sponsored plan?

In most cases, employer-sponsored plans fail to deliver the protection most MDs require. They're good for auxiliary workers such as receptionists but do not take into account the unique challenges and income that come with specialized training.

What do rates look like?

Great question, and of course, they vary based on many factors. One of the reasons why MDs choose InsuranceMD is our unique ability to save them 30%- 50% off retail rates. Click to book your call and get specific rates today.

Ready To Protect Your Career, Family & Future Earnings Potential—For Less?

At any moment, your ability to generate income can significantly change.

Book your call with InsuranceMD’s expert team today to discover the power of True Own protection.

© 2023 InsuranceMD™. All Rights Reserved